Country Search

Find Your Salary After Tax

Calculate your net income effortlessly with our accurate and regularly updated income tax calculators

Overview of Income Tax Calculators

TaxAssist+ free online calculators provide precise salary and inheritance tax estimates and are continually updated for accuracy. However, they’re not a replacement for professional financial advice. Consult a financial professional or tax expert before making decisions based on any calculator results.

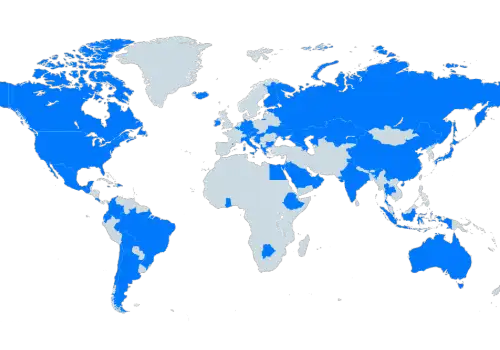

Number of countries covered: 53+ (30% of the world)

United States

USA Tax Calculator

Estimate your federal income taxes for the 2023/24 tax year. Enter your gross income to begin:

U.S. State Tax Calculators

Countries

Country Tax Calculators

*Updated for 2024/25

North America

South America

Europe

Asia

Oceania

Africa

Found an issue with any of our calculators? Send us a message →

$0 Fed. $0 State. $0 to File. For simple tax returns only. See if you qualify.

View our advertiser disclosure here.